Debt is one of the most common financial problems people face, and it can feel overwhelming — like a weight that just won’t go away. But with the right strategy and mindset, getting out of debt is absolutely possible. Whether you’re struggling with credit cards, personal loans, or any other kind of debt, this step-by-step guide will help you build a plan to regain control and start fresh.

Understand Your Debt Situation

Before you can pay off debt, you need a clear picture of what you owe. Start by listing:

- The total balance of each debt

- The interest rate

- The minimum monthly payment

- The due dates

Include all types of debt: credit cards, student loans, auto loans, medical bills, personal loans, etc. Seeing everything in one place is crucial for building your repayment plan.

Stop Accumulating More Debt

This may sound obvious, but it’s an essential step. If you’re still using credit cards, taking out loans, or financing purchases, it’s like trying to bail water from a sinking boat without plugging the leak.

Pause all unnecessary spending and avoid using credit for anything that isn’t an emergency. Shift your focus to living within your means.

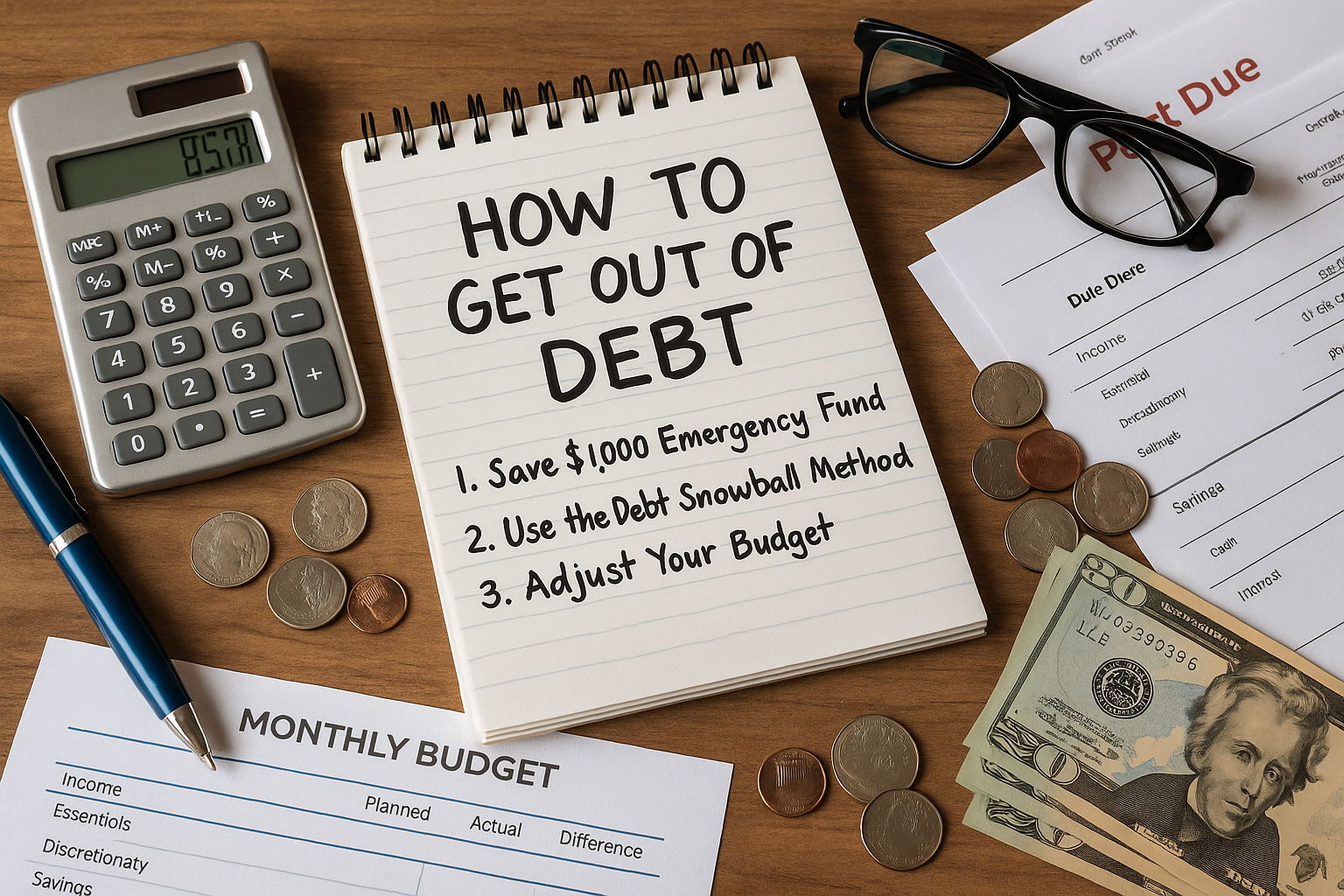

Build a Starter Emergency Fund

Unexpected expenses can ruin a debt repayment plan. Before aggressively paying down debt, save a small emergency fund — even just $500 to $1,000 — so you’re not forced to use credit when something goes wrong.

Choose a Debt Repayment Strategy

There are two main methods to repay debt, and both work. Choose the one that keeps you motivated:

1. Debt Snowball Method

- Pay off the smallest debt first

- Make minimum payments on the rest

- Once the smallest debt is gone, apply that payment to the next smallest

This method builds momentum and motivation through quick wins.

2. Debt Avalanche Method

- Focus on the debt with the highest interest rate

- Make minimum payments on the rest

- Once it’s paid off, target the next highest interest debt

This method saves more money on interest over time, but can feel slower.

Create a Realistic Monthly Budget

You need to know exactly how much you can put toward debt each month. Go through your budget and cut back where possible — especially on non-essential spending like:

- Dining out

- Subscriptions and memberships

- Shopping and entertainment

Redirect that money to your debt. Every extra dollar counts.

Negotiate with Creditors

If your debt feels unmanageable, reach out to your lenders. You might be able to:

- Lower your interest rate

- Get a temporary payment pause

- Set up a new payment plan

- Settle the debt for less than you owe (in some cases)

Be honest about your situation. Creditors are often willing to work with you if you’re proactive.

Consider Debt Consolidation (Cautiously)

If you have multiple high-interest debts, consolidating them into one loan with a lower interest rate can simplify repayment and save money. Just be careful:

- Make sure the new loan has better terms

- Avoid taking on more debt afterward

- Only use trusted financial institutions

Personal loans, balance transfer credit cards, and debt management plans are common consolidation tools.

Use Extra Income to Accelerate Payments

Find ways to boost your income and apply it directly to your debt:

- Freelance or part-time jobs

- Sell unused items

- Use bonuses or tax refunds

- Offer services like tutoring, cleaning, or delivery

Even an extra $200 a month can make a big difference.

Track Progress and Celebrate Milestones

Getting out of debt can take time, so it’s important to stay motivated. Track your progress with a visual chart or spreadsheet. Celebrate when you:

- Pay off a credit card

- Hit a new balance milestone

- Reach the halfway point

These small wins build confidence and keep you going.

Stay Committed to a Debt-Free Life

Once you’re debt-free, stay that way. Build a full emergency fund, create sinking funds for future expenses, and continue budgeting. Living without debt brings freedom, peace of mind, and the opportunity to build wealth instead of surviving month to month.

You’re Not Alone — And You Can Do This

Millions of people have paid off debt and taken back control of their lives. You can too. It doesn’t require perfection — only a plan, discipline, and persistence. The sooner you start, the sooner you’ll feel the relief of financial freedom.