Entering a serious relationship or getting married is one of the most significant life decisions anyone can make. Along with emotional commitment, financial compatibility and planning are crucial for the success of the partnership. Money is one of the most common sources of stress in relationships, and being on the same page financially can make a huge difference in the quality of your relationship. Organizing your finances before making this step can help ensure that both partners are aligned and prepared for the financial challenges ahead.

The Importance of Financial Planning Before Marriage

Before taking the plunge into marriage or a serious relationship, it’s important to have open discussions about money. Financial issues, if left unaddressed, can lead to stress, arguments, and even separation in some cases. By being transparent about your financial situation, discussing financial goals, and setting expectations, you can avoid surprises and build a strong financial foundation together.

Financial Compatibility: The Key to Harmony

Financial compatibility is the ability of two individuals to manage their finances in a way that benefits their relationship. It doesn’t mean that both partners need to have the same approach to money, but it’s important to have shared goals and an understanding of each other’s financial habits.

Some key areas of financial compatibility include:

- Spending habits: Are both partners savers or spenders? Understanding each other’s approach to saving and spending is essential for building a solid financial partnership.

- Debt management: Do either of you have outstanding debts? How are you planning to handle them together? Having open discussions about how to tackle debt as a couple is vital.

- Saving goals: Are both partners interested in saving for long-term goals, such as buying a house, traveling, or retirement? Aligning savings goals will help avoid conflicts down the road.

Discussing Financial History and Debts

One of the most important conversations you should have before getting married or entering into a serious relationship is about your financial history. This includes disclosing your debts, credit scores, and any financial obligations you may have. Honesty is key to understanding each other’s financial past and working together to create a financial plan for the future.

How Much Debt Do You Have?

It’s essential to have an honest discussion about any debts, whether it’s student loans, credit card debt, car loans, or mortgages. This conversation will help you understand each other’s financial burdens and come up with a plan to manage and pay off debts.

If one partner has a significant amount of debt, the other may need to make sacrifices or adjustments to their own financial goals. Knowing about debt before marriage also ensures that both partners understand the financial dynamics of the relationship.

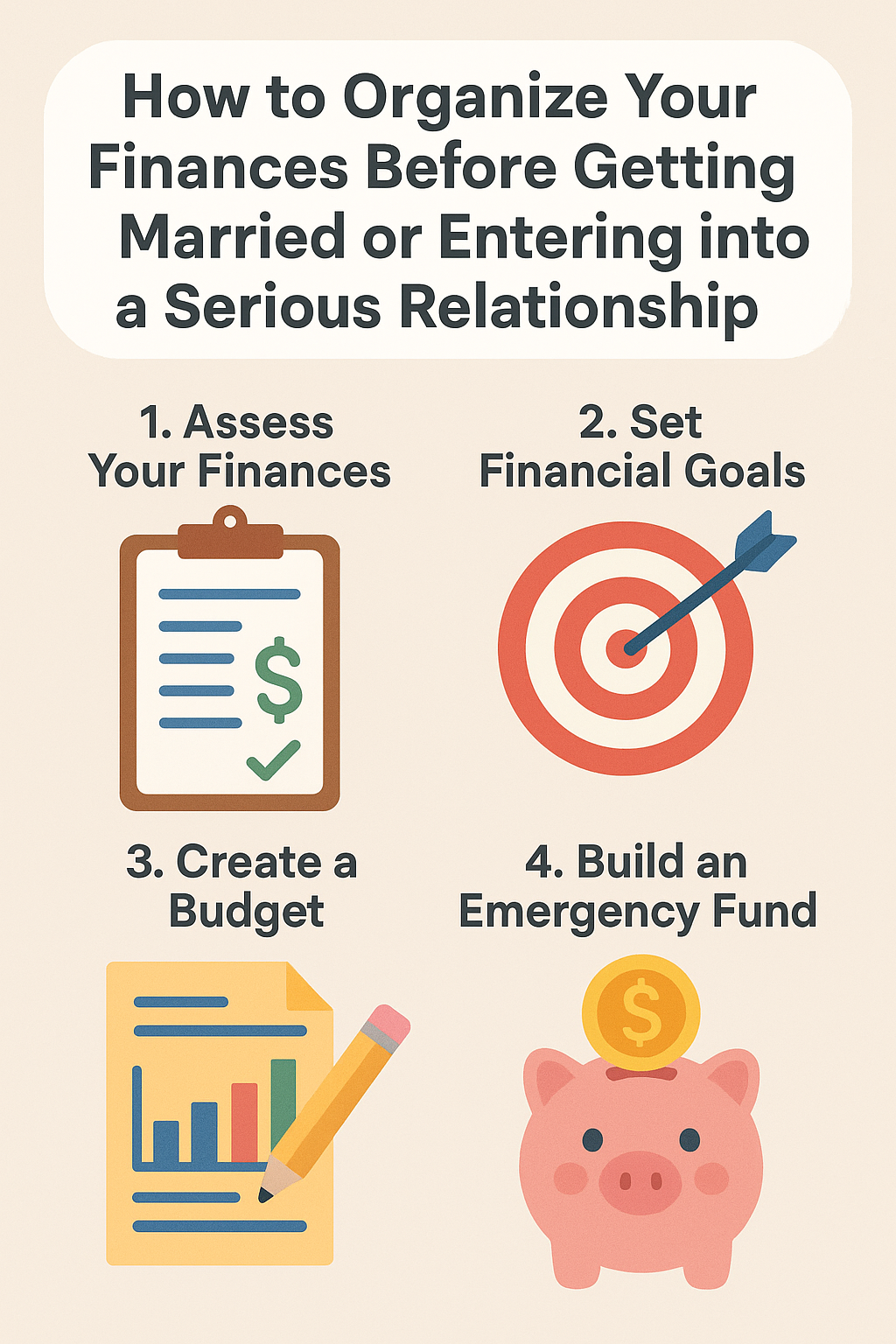

Steps to Organize Your Finances Together

Once you’ve had the crucial conversation about your financial history and goals, it’s time to start organizing your finances together. Here are several steps to help you both get on the same page financially:

1. Create a Joint Budget

A joint budget is an essential tool for managing finances together. A budget helps track your expenses, ensure that bills are paid on time, and allow both partners to contribute to shared financial goals. Discuss how much each partner will contribute, whether it’s a percentage of income or a fixed amount.

Make sure to account for all household expenses, including rent, utilities, groceries, transportation, and entertainment. A budget also allows for savings, investments, and emergency funds, which are critical in building financial security as a couple.

2. Build an Emergency Fund Together

Life is unpredictable, and unexpected expenses will arise. Having an emergency fund is vital for both partners to feel secure in their financial future. Start saving a portion of your income together, aiming for at least three to six months’ worth of expenses in your emergency fund. This fund will help you both handle unexpected costs, such as medical bills, car repairs, or job loss, without derailing your financial stability.

3. Decide How to Manage Joint and Separate Accounts

Deciding how to manage finances in a relationship can be tricky. Some couples prefer to combine all their finances, while others choose to keep certain accounts separate. There are no right or wrong answers here—it depends on your preferences and what works best for both of you.

Options include:

- Joint accounts: All income and expenses are shared equally. This can make budgeting easier but requires strong communication.

- Separate accounts: Each partner maintains their own accounts and is responsible for their own expenses. This might be ideal if both partners prefer financial independence.

- Combination: Many couples find a combination works best, where they maintain separate accounts for personal spending but have a joint account for shared expenses like rent, utilities, and savings.

4. Plan for Long-Term Financial Goals

Before marriage or a serious commitment, you should both be aligned on your long-term financial goals. These might include buying a home, traveling, starting a family, or retiring comfortably. Knowing each other’s goals helps you build a financial plan to work towards them together.

Start by discussing your goals for the next 5, 10, and 20 years. Break down each goal into smaller, actionable steps, and prioritize them based on importance. Consider setting up a joint savings or investment account to help fund these long-term goals.

5. Understand Each Other’s Financial Expectations

Understanding each other’s financial expectations is essential for avoiding misunderstandings later on. Discuss your expectations for things like:

- Who will pay for what? Will one person handle certain bills or expenses, or will everything be split evenly?

- How will large purchases be handled? Will you consult each other before making big purchases like a new car or expensive vacation?

- How much should be saved or invested each month? Setting expectations around savings helps ensure that both partners are contributing to future goals.

6. Review Your Insurance and Retirement Plans

Before committing to a serious relationship or marriage, review your insurance and retirement plans together. This includes life insurance, health insurance, and retirement accounts like 401(k)s or IRAs. Understanding each other’s coverage and contributions to retirement ensures that both partners are on the same page regarding future financial security.

Conclusion: Building a Financial Foundation for a Successful Relationship

Organizing your finances before getting married or entering into a serious relationship is essential for building a strong foundation for your future together. By having honest discussions about your financial history, setting clear goals, and working together to create a budget, you can prevent money issues from causing stress in your relationship.

Financial compatibility and transparency are the keys to avoiding misunderstandings and ensuring a harmonious relationship. The effort you put into organizing your finances will not only lead to financial success but also strengthen your bond as a couple, making your relationship even more fulfilling.