Building an emergency fund is one of the most crucial steps in securing your financial future. Life is unpredictable, and having a safety net can help protect you from unexpected expenses, such as medical bills, car repairs, or sudden job loss. In this article, we’ll guide you through the process of building an emergency fund from scratch, step by step.

1. Understand Why You Need an Emergency Fund

Before you start saving, it’s important to understand why having an emergency fund is essential. An emergency fund serves as a financial cushion to help you handle unexpected expenses without relying on credit cards or loans.

Benefits of an Emergency Fund:

- Peace of Mind: Knowing you have money set aside for emergencies helps reduce stress and anxiety about unforeseen expenses.

- Avoid Debt: With an emergency fund, you can avoid going into debt when unexpected costs arise.

- Financial Security: It gives you the security to handle life’s uncertainties, such as a job loss or health issue, without derailing your financial progress.

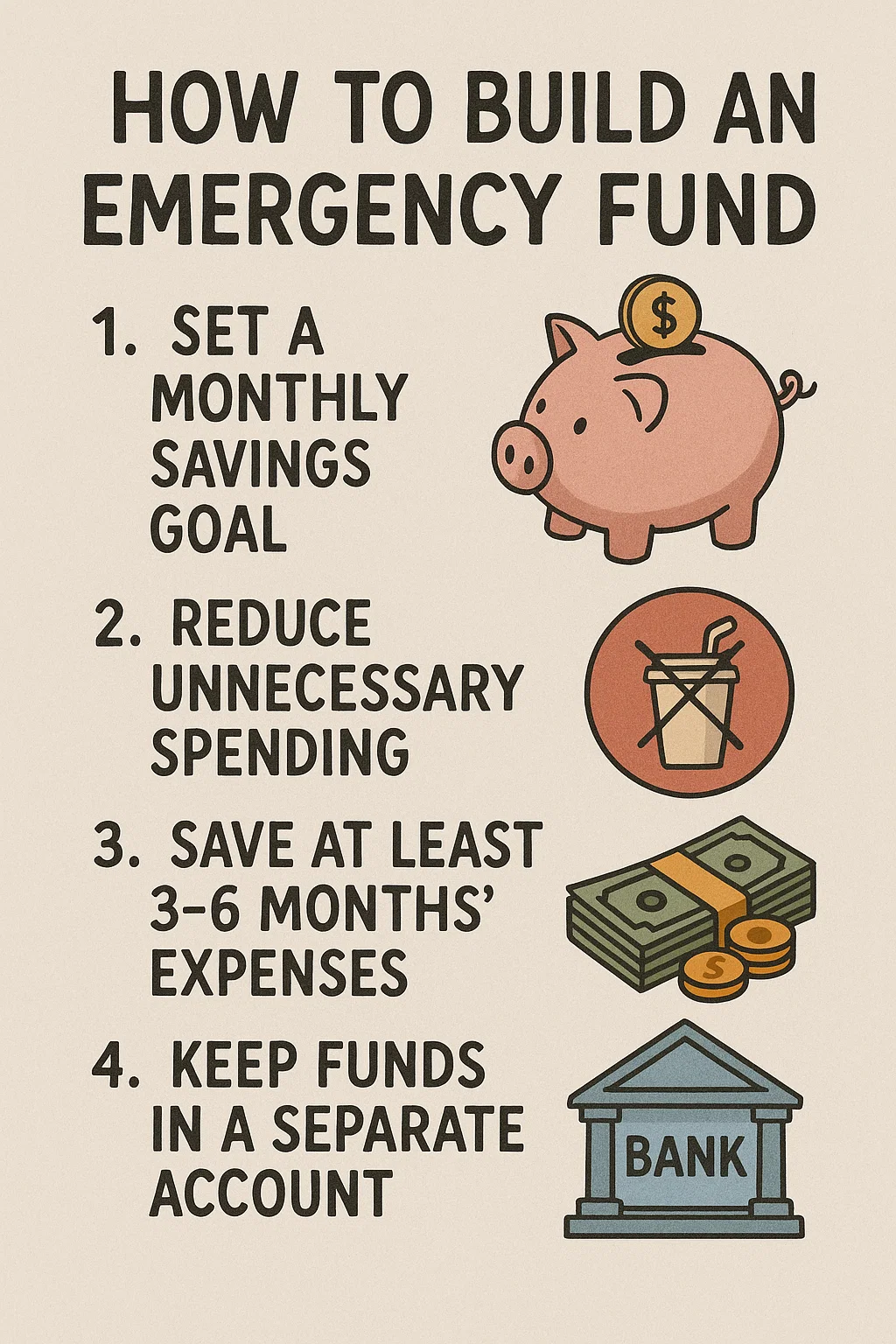

2. Set a Realistic Savings Goal

The next step is determining how much money you need in your emergency fund. Financial experts generally recommend having three to six months’ worth of living expenses saved up in an emergency fund.

How to Calculate Your Savings Goal:

- Fixed Expenses: Start by calculating your monthly fixed expenses, such as rent/mortgage, utilities, insurance, and car payments.

- Variable Expenses: Next, estimate your monthly variable expenses, such as groceries, transportation, and entertainment.

- Total Monthly Expenses: Add up both fixed and variable expenses to determine your total monthly cost of living.

- Multiply by Three to Six Months: Once you have your total monthly expenses, multiply that amount by 3 to 6 months to get a range for your emergency fund goal.

For example, if your total monthly expenses are $3,000, your emergency fund should range from $9,000 (3 months) to $18,000 (6 months).

3. Open a Separate Savings Account

To keep your emergency fund separate from your regular spending money, it’s a good idea to open a dedicated savings account. This will make it easier to track your progress and ensure that the money is used only for emergencies.

Types of Accounts to Consider:

- High-Yield Savings Account: Look for a high-yield savings account with a good interest rate. This allows your money to grow while still being easily accessible.

- Money Market Account: Money market accounts often offer higher interest rates than regular savings accounts and allow limited check-writing access.

- Online Savings Account: Many online banks offer savings accounts with higher interest rates than traditional banks, making them a good option for growing your emergency fund.

Avoid keeping your emergency fund in a checking account, as it may tempt you to spend it on non-emergencies.

4. Start Saving Small Amounts Consistently

Building an emergency fund doesn’t have to happen overnight. The key is to start small and make consistent contributions over time. Even saving a small amount each month will add up and get you closer to your goal.

How to Get Started:

- Set a Monthly Target: Determine how much you can afford to save each month. For example, if you want to save $6,000 in a year, you would need to save $500 per month.

- Automate Your Savings: Set up automatic transfers from your checking account to your emergency fund account each month. This makes saving easier and ensures you don’t forget to contribute.

- Start with What You Can: If you can’t afford to save a large amount, start small. Even saving $50 to $100 a month will make a difference over time.

Consistency is more important than the amount. As your income increases, you can gradually increase your contributions.

5. Cut Back on Unnecessary Spending

To speed up the process of building your emergency fund, you may need to cut back on unnecessary spending. Take a close look at your budget and identify areas where you can reduce costs.

Areas to Cut Back:

- Dining Out: Eating out can be one of the largest expenses in a household. Consider cooking at home more often and limiting dining out to special occasions.

- Subscription Services: Review your subscriptions to services like Netflix, Spotify, or magazine subscriptions. Cancel any that you don’t use regularly or need.

- Impulse Purchases: Avoid impulse buying by waiting 24 hours before making a purchase. This will help you prioritize your spending and avoid buying things you don’t need.

Redirect the money you save from these areas directly into your emergency fund.

6. Use Windfalls and Extra Income

If you receive unexpected money, such as a tax refund, work bonus, or gifts, consider putting it into your emergency fund. This can significantly boost your savings without affecting your regular budget.

How to Use Windfalls:

- Tax Refunds: Instead of spending your tax refund on unnecessary purchases, put it toward your emergency fund.

- Work Bonuses: If you receive a bonus at work, consider saving a portion of it for emergencies.

- Side Hustles: If you earn extra income through side jobs or freelancing, dedicate a portion of that income to your emergency fund.

Using windfalls and extra income is a great way to accelerate your savings progress without impacting your regular finances.

7. Avoid Using Your Emergency Fund for Non-Emergencies

One of the biggest mistakes people make with their emergency fund is using it for non-emergencies. Remember, your emergency fund is meant to be used for true emergencies, such as unexpected medical bills, car repairs, or job loss.

What Constitutes an Emergency:

- Medical Bills: Unexpected health issues or accidents can lead to significant medical expenses.

- Car Repairs: If your car breaks down and you need it for commuting to work, it’s an emergency.

- Job Loss: If you lose your job, your emergency fund can help cover living expenses until you find new employment.

If you use your emergency fund for non-essential purchases, you’ll jeopardize your financial security in the long term. Only use the money for its intended purpose.

8. Monitor Your Progress and Adjust as Needed

Building an emergency fund is a long-term goal, so it’s important to monitor your progress regularly. If you’re falling behind, adjust your savings plan to stay on track.

How to Monitor Your Progress:

- Review Your Savings: Check your emergency fund balance regularly to track your progress. Celebrate small milestones, like reaching $1,000, $5,000, or another key amount.

- Adjust Your Plan: If your financial situation changes, such as a salary increase or additional expenses, adjust your savings goal accordingly.

Keep your emergency fund a priority, and stay disciplined in your savings efforts.

Conclusion: Be Patient and Stay Consistent

Building an emergency fund takes time, but it’s one of the most important financial steps you can take to ensure financial security. Start small, stay consistent, and gradually increase your contributions. By setting a realistic goal, automating your savings, and cutting back on unnecessary expenses, you can build a strong safety net to protect yourself from life’s unexpected events.

Remember, an emergency fund isn’t something you achieve overnight—it’s a long-term goal. But with patience and persistence, you’ll get there, and your financial peace of mind will be well worth the effort.